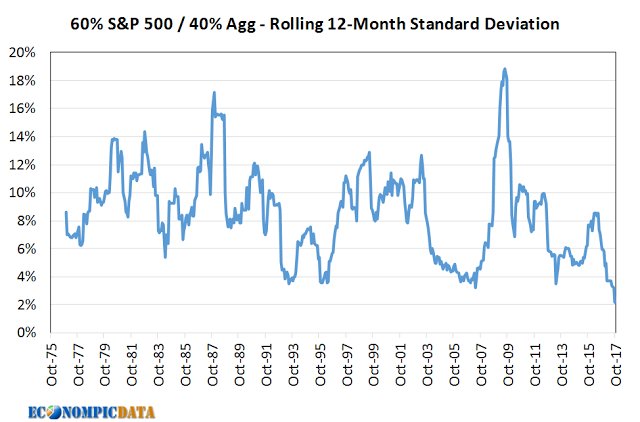

While I doubt there are any surprises here as you can’t go more than a couple of scrolls on your Twitter feed without seeing something about how low VIX is, it nonetheless raises some good talking points.

The first thing is capital markets are like pendulums with a lot of things. Foreign equities dramatically outperformed domestic in the 2000's. This decade, domestic is way ahead of foreign - until this year. Same thing with currencies, the dollar goes on long runs of outperformance, followed by long periods of underperformance and so on. Where volatility has been low and headed lower this year, it will at some point turn around and move higher. That is not a prediction that I am trying to game so much as an observation of how markets work and a reminder for practice management, take the time to remind clients that market cycles and volatility have not been repealed.

To that point John Hussman’s latest commentary is a doozy. He says that based on his study of valuations versus interest rates and a few other things, he believes that a 64% decline is coming to the S&P 500 (NYSEARCA:SPY) with the expectation that the next 10-12 years will offer negative returns.

If you know who John Hussman is, you know that he has been bearish all the way up. The way I always mention him is to say, he does a great job of framing the bear case, and that is what he is doing; valuations are out of whack given where interest rates are. He hasn’t really drawn the correct conclusion in that he positioned against the market rising and his flagship fund has suffered for it.

- Source, Seeking Alpha