Iran and Venezuela Not Coming Back Anytime Soon

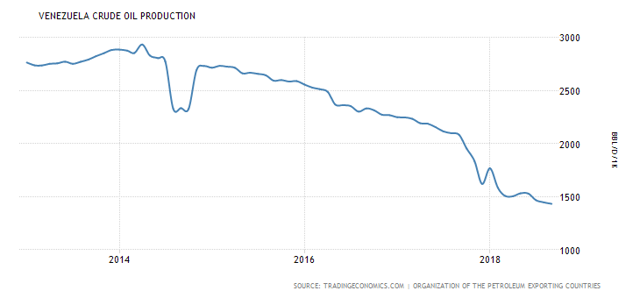

First, we have supply severely reduced from Iran and Venezuela. Historically, Venezuela has produced as high as 3.45 million barrels a month, a high hit in 1997. Before the oil crash of 2014, it was pumping about 2.5 million a day, and ever since the country’s collapse, that figure has gone down steadily, now to 1.43 million, a day and will likely fall further as the society there unfortunately continues to deteriorate.

The country’s idea for its oil-backed cryptocurrency, the Petro, as an OPEC standard to save its economy can barely be called half-baked. Socialist controls have not let up, nor will they without some sort of coup or revolution, which would temporarily disrupt current oil exports even more severely. As for Iran, before the nuclear deal, exports reached a low of 3 million barrels a day.

As of September, exports were at 3.76 million a day, so we have about another 760,000 barrels a day to fall. Taken together, I estimate that for these two countries, we will see a combined fall of 1 million barrels a day by Q1 of next year.

- Source, Seeking Alpha